To say the least I was surprised and very skeptical of this claim.

To evaluate I dug deeper into the article and then the data they used.

First of all the NAICS code [53] Real Estate Rental and Leasing (RERL) accounts for more than what is claimed by "better dwelling":

RERL is the contribution to GDP made during managing, selling, renting and/or buying real estate. To simplify it, it’s the commissions made from managing real estate transactions.Although not nearly as significant it also includes other rental and leasing such as automotive, and consumer and commercial equipment, albeit this is a small component of RERL accounts. To simplify it is NOT just the commissions made from managing real estate transactions

Second. I am not entirely confident in how they determine that RERL accounts for just over 50% of the increase in annual GDP.

My Methodology in calculating:

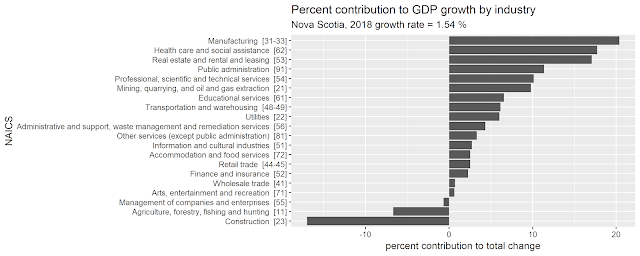

- Obtain GDP by industry from StatsCan. Canada this is 2018Q3 and 2019Q3, for all other provinces listed this 2017 and 2018 annual GDP.

- Calculate the growth rate of each industry.

- Determine the weight of each industry in relation to total GDP.

- Determine the weighted growth rate of each industry.

- Divide the weighted growth by the total growth to find the percent contribution to total growth.

The results of this methodology for Canada and each province is presented below. Note, for 2019Q3 I calculate Real Estate Renting and Leasing to only account for about 27% of the GDP growth. Mind you this is up substantially from 2018 where it accounted for only about 11% of the GDP growth.

The graphs below are presented without any further discussion.