|

| Source: http://www.oecd.org/social/affordable-housing-database.htm |

Since the proposed speculation tax in the 2018 BC budget, the news has blown up with opinion pieces and articles in opposition to this tax. some examples can be found

here and

here, although there are many more.

Predominately it seems that the majority of the outrage comes down to a misunderstanding of the tax due to a poor choice of naming. That is, the outraged cry is usually along the lines of

"I am not a speculator, I just have a home in Saanich which I only live in a few months in the summer because I love the area"

True, these individuals are

not speculating, but the problem still remains, they own a piece of capital (housing stock) which they are choosing to allow to sit idle while so many individuals in the region are unable to find housing, let alone affordable housing.

Thus the trouble is in the name, this should not be labelled as a speculation tax but rather a vacant homes tax. In this way, we get around the problem that keeps arising from people feeling as if they are being labelled as a speculator while addressing the real problem of an idle capital stock.

The recent article listed above (first hyperlink) by the Times Colonist claims that the new tax will be a job killer as it will depress the housing market due to the fact that people will no longer be buying properties (

to sit vacant for the majority of the year).

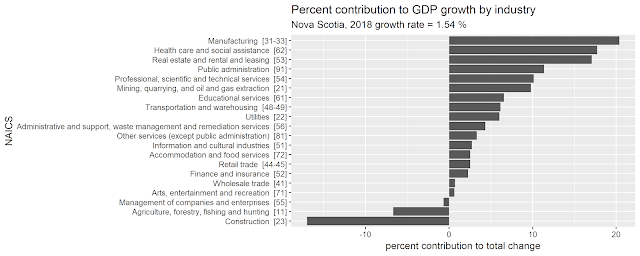

True, if this tax successfully decreases the housing market - this will hurt the BC economy in the short-run. Currently, the FIRE (Finance, Insurance, Real Estate) industry accounts for about 25% of BCs GDP (

23% in 2012,

24% in 2016), making it the largest contributor to BCs economy by far. That is, if this tax successfully pushes down housing prices, it will ripple through the entire FIRE industry, pushing down BC's GDP, pushing up unemployment (all else equal in the short-run).

Does this then mean its a bad thing? Well yes... but.

The alternative is we do nothing, we allow capital to continue to sit idle, allow housing prices to continue to inflate exponentially faster than wages until we arrive at such a discrepancy (currently being seen in Toronto, Vancouver, etc.) that professionals can no longer afford to live in these municipalities, which similarly hurts jobs as there is no labour to be had. (

here,

here).

Along these lines talking to several HR professionals in the CRD I am continually hearing the same story that the only applicants they receive are either (A) from established (

older, near retirement) Victora applicants or (B) from Vancouver (

higher priced market). Any time a qualified applicant is offered a job outside of these two areas the applicant resultingly turns down the offer due to lack of housing.

If labour refuses to move here for jobs then employers have two options. They can either (A) begin to offer higher salaries (

which would help offset the cost of living) or (B), if possible, they will relocate to other areas which jointly offer lower wages as well as cheaper land, thus jointly decreasing two costs of production.

So yes, this tax does stand to hurt us today - the alternative is prolonged hardship and a flow of labour out of the region, similarily contracting the economy in the future.

What are your thoughts on the new speculation (

vacant homes) tax? will the benefits of this tax outweigh the costs or will the distortionary effects of a tax create more harm than good? feel free to comment below.